Kelsey Lynn-Skinner

Technology Partner, IP Group plc

Start-up boards are always interesting, frequently challenging, but often dysfunctional. Operating, as most start-ups do, with an unproven business model and/or limited resources brings difficulties. And the same exceptional and extreme personalities, which enhance innovation and entrepreneurial success, pose challenging dynamics in the boardroom.

Having been on many boards in Silicon Valley and the UK as a venture investor, I have seen a lot and highlight here four common problems. If not addressed, these can lead to a dysfunctional board, and ultimately hinder the company’s performance or even survival.

Problem one … one person dominates your board meetings.

Some start-up boards can involve a founder, CEO or investor effectively holding court and micro-managing the conversation to get agreement with their own (pre-formed) conclusion.

Solution – In my experience this should be addressed head-on. Some approaches which I have seen work are having a 1-on-1 meeting with the protagonist to discuss their dominance and encourage dissent; exploring their removal from the board; or even bringing on another strong personality into the boardroom to act as a counterbalance.

Result – Sharing of a diversity of perspectives and vital expertise to empower the CEO.

Problem two… misalignment or lack of clarity about what a company does.

Whilst a clear pivot can be game-changing for start-ups, a common understanding on strategic direction can be easily lost in such a dynamic context. A key sign is where board meetings become backwards-looking ‘progress reports’, rather than shaping the firm’s future.

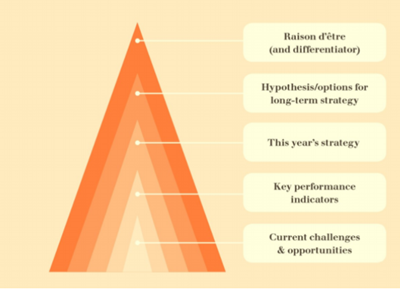

Solution – Often this is flushed out in pulling together the pitch-deck for a new funding round. In lieu of this, a strategic exercise within the board can be hugely beneficial. For example, discussing as a board the answer to each area in this diagram – and crucially, getting agreement!

Result – a board which guides and shapes the company’s strategic direction. And a start-up which has a compelling pitch-deck ready to pull out at a moment’s notice!

Problem three… the elusive ‘good’ board pack.

Start-ups can have a myriad of problem with their board packs – from the lack of one completely, to one which lacks cohesion or clarity, or worse, one where the CEO masks under-performance.

Solution – this can be fall-out from one or both of the issues above. A clear strategic direction should also link to effective KPIs to report to the board on. Equally, an over-stretched CEO may also struggle to produce a quality board pack, so the Chair may need to lead for a time.

Result – board meetings which bring together the collective expertise on the key decisions and issues facing the firm, and NEDs who have the requisite understanding of the company’s activity to apply their knowledge effectively.

Problem four … personal situations get in the way.

Most start-up board members have multiple ‘hats’ linked to their share holdings, connections with parent companies or personal loyalties. I’ve seen this be most damaging with venture investors and founders allowing these external or personal priorities

impact decisions for the company.

Solution – the problem here is not that these conflicts exist, which they almost always do, but in how openly it is discussed and managed (or not) in the boardroom.

Result – Individual members should be able to articulate which ‘hat’ they are wearing, and how priorities may conflict, to enable frank and balanced discussion.

Finally, board member band-width is a very common problem in the start-up space.

Addressing these issues of these challenging board dynamics can take a lot of time, focus and effort. However, it is almost always quicker and easier and ultimately worthwhile to put the board back on the right course sooner rather than later.

Because while start-ups can have challenging board dynamics, the upside is worth it: these companies are bringing new technologies and ideas to market and, addressing these issues, you can play a critical role in realising that success.